HOODX 5.0: XVerse

Nationwide on Comcast, Time Warner, Verizon Fios, and RCN

How Americans will spend their tax refund

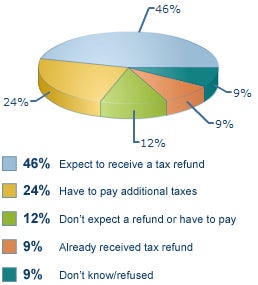

- 54 percent expect to get a tax refund; 24 percent say they owe money.

- Only 7 percent plan to splurge on something fun, like a vacation.

- Of those who owe money to Uncle Sam, only 6 percent plan to borrow.

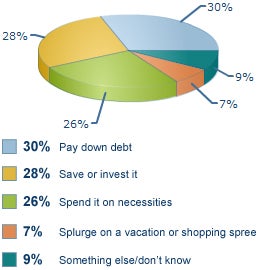

Recession-weary taxpayers awaiting a tax refund check from Uncle Sam will not indulge in unbridled consumer spending this year. Instead, 84 percent of Americans receiving refunds intend to pay down debt, save or invest their windfall or use it for everyday necessities, according to a new Bankrate.com poll.

Only 7 percent plan to fritter the money away on a shopping spree or vacation.

On the other hand, 40 percent of those who believe they owe taxes say they are not prepared to pay up. Nevertheless, only 6 percent plan to borrow money, though 17 percent say they intend to set up an installment plan with the IRS.

A whopping six in 10 people (63 percent) will pay their taxes with funds straight from their bank accounts.

Bankrate commissioned Princeton Survey Research Associates International to gauge Americans' feelings about the looming tax deadline and whether or not they're prepared to pay the taxman.

What we'll do with the refund

Overall, 30 percent of Americans intend to pay down debt with their tax refund, 28 percent say they will save or invest it, and 26 percent have earmarked those funds for necessities such as food or utility bills.

"I think it is a sign about how people feel about the economy and where we are going. There is still a lot of uncertainty out there," says Bryan Pukoff, CPA and principal at Rehmann, one of the largest financial services, accounting and consulting firms in the Midwest.

"That is different than what we have seen in the past. People generally take a portion of their refund and spend it on something for themselves -- a vacation or a new car. The percentages actually surprise me," he says.

Greg McBride, Bankrate.com's senior financial analyst, points out that regardless of economic conditions, putting the money directly into an IRA would be a smart move from a financial planning point of view.

How we'll get the money

The vast majority of Americans, 88 percent, will receive their refunds via check or direct deposit from the U.S. Treasury.

The survey showed that 3 percent of respondents plan to have their refund deposited into multiple accounts, including an IRA.

"I find that troubling, considering how woefully under-saved for retirement our society is," McBride says.

"The recent survey from the Employee Benefit Research Institute showed that 54 percent of Americans have less than $25,000 saved for retirement. The tax refund is the biggest windfall people are going to get all year," he says.

Three percent of those getting a refund took a refund anticipation loan. For people with incomes under $30,000, that number jumps to 6 percent.

"Here is what that really means: You gave your money to the government for free all year and now you need it back so quickly that you're going to pay a high interest rate just to get your own money back that you could have had all year," says McBride.

Read more: http://www.bankrate.com/finance/taxes/how-americans-will-spend-thei...

Follow us: @Bankrate on Twitter | Bankrate on Facebook

Tags:

Replies to This Discussion

© 2024 Created by Wyzdom.

Powered by

![]()